In the ever-evolving landscape of cryptocurrency mining, the ASIC hosting price trends have become a focal point for investors, miners, and operators alike. ASIC (Application-Specific Integrated Circuit) miners, specially designed for mining cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), are the backbone of modern mining farms. As the demand for processing power intensifies, understanding the fluctuations in hosting costs is pivotal for anyone involved in this industry.

Mining machine hosting refers to the service where users place their mining rigs in a professional data center, ensuring optimal electricity supply, cooling, security, and maintenance. This arrangement relieves individual miners from the burden of managing hardware in less-than-ideal conditions. However, hosting prices are seldom static; they swing in response to energy costs, technological advancements, and market dynamics. For BTC miners, whose rigs consume significant power, the hosting expense often forms a substantial fraction of operational costs.

Delving deeper into the factors influencing ASIC hosting expenses, electricity prices stand at the forefront. With mining devices operating 24/7 at high performance, energy consumption is paramount. Regions boasting low electricity costs, such as parts of China, Kazakhstan, and Iceland, attract bulk hosting contracts, but geopolitical shifts and regulatory changes in these areas can dramatically alter pricing trends. As renewable energy adoption grows, new hosting models emerge, offering greener alternatives but at a premium. Hence, the cost-benefit analysis becomes more intricate, weighing sustainability against profitability.

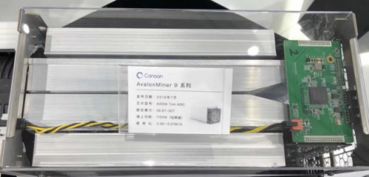

Another driver behind hosting cost volatility is technological progression in mining rigs themselves. The latest ASIC units pack more hash rate per watt, effectively improving energy efficiency. However, these high-performance miners also command a higher initial investment and can lead to elevated hosting rates because of increased cooling and power requirements. Conversely, legacy rigs, like earlier models used for DOGE (Dogecoin) or combined ETH mining, may enjoy discounted hosting but suffer from reduced ROI in a competitive network.

Cryptocurrency market conditions also dictate hosting expenditure. When Bitcoin prices surge, mining activities heat up, and demand for hosting spaces spikes, causing price hikes. Likewise, a market downturn induces hesitancy in miners to expand or renew contracts, leading to potential price dips. This cyclical nature challenges hosting providers to balance maintaining profitability while catering to miners’ shifting budgets. Hosting service providers sometimes offer flexible plans, including profit-sharing models or contract durations linked to coin price indices, weaving a complex web of cost variables.

Mining farms are increasingly integrating multi-currency support, addressing not just Bitcoin but also altcoins like Ethereum and Dogecoin. Shipment and installation of specialized miners tailored for these currencies further diversify the hosting landscape. For example, ETH mining requires different hardware and electricity considerations compared to BTC, breaking standard hosting price schemas and adding layers to what miners can expect to pay. Additionally, the rise of mining pools and cloud mining platforms fosters decentralized participation, affecting demand for physical hosting units differently than individual or institutional miners.

It’s also essential to consider exchange trends and their impact on hosting pricing strategies. As exchanges streamline access to cryptocurrencies, providing easier liquidity and trading opportunities, miners recalibrate operations to align with price trends and network difficulties. Increased volatility in exchanges like Binance or Coinbase can prompt quick shifts in mining power deployment and, subsequently, hosting space rental patterns.

Looking ahead, ASIC hosting price trends will likely mirror the broader cryptocurrency ecosystem’s trajectory. Innovations in hardware efficiency, energy sourcing, and market regulations will continue to interplay, influencing cost structures. Miners who proactively adapt—through strategic hosting partnerships, diversified currency portfolios, and dynamic contract models—will be best positioned to thrive amid this flux.

In essence, anticipating ASIC hosting costs demands a holistic grasp of the intertwining forces at play: from energy markets and miner technology to cryptocurrency valuations and decentralized financing. With the mining industry poised as both an energy consumer and a pivotal blockchain contributor, the coming years promise a fascinating dance of adaptation and opportunity in hosting economics.

Expect volatile ASIC hosting prices. Demand, energy costs, and mining profitability heavily influence rates. Stay informed to optimize your mining strategy and maximize returns amidst fluctuations.